Supermarket giant Kroger (KO) is gearing up for its third-quarter earnings report, due out before the market opens on Thursday, Nov. 30. The stock jumped 3.1% after earnings after beating quarterly estimates in its September report, one of five positive post-earnings moves in the last two years.

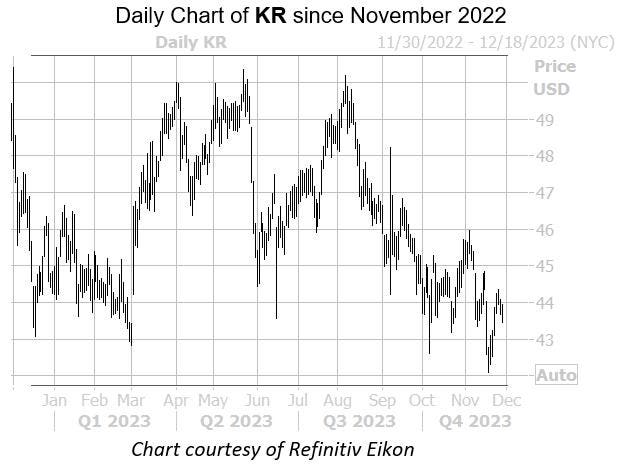

Kroger stock has been sliding on the charts this year, however, recently hitting a one-year low of $42.09 on Nov. 17. On track for its third-straight loss, the equity is also facing off with its year-to-date breakeven level.

Put traders are flooding KR’s options pits ahead of the event. So far, 14,000 puts have been exchanged, four times the intraday average volume, in comparison to 4,469 calls. The weekly 21/1 43-strike put is the most popular, where new positions are being bought to open.

Kroger stock has seen strong bearish sentiment in the options pits for the past couple weeks as well. KR’s 50-day put/call volume ratio of 1.67 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks higher than 98% of readings from the past year.

Plus, short interest has been building, up 18.2% in the last two weeks. It would take shorts five days to cover, at the equity’s average pace of trading, and an unwinding of some of this pessimism could give the stock a short-term boost.

Read the full article here